Proprietorship incorporation

Proprietorship incorporation

The structure you're describing is commonly referred to as a Limited Liability Partnership (LLP). An LLP combines elements of both a partnership and a corporation, allowing partners to enjoy the benefits of limited liability while still participating in the management of the business. This means that personal assets of the partners are generally protected from business debts and liabilities, providing a layer of security typically associated with corporations, while retaining the flexible operational structure of a partnership.

Pros:

- Easiest and cheapest to set up.

- Minimal compliance requirements.

- Complete control over the business.

Cons:

- Unlimited liability – personal assets are at risk.

- Limited growth potential and access to funding.

- Less credibility compared to other structures.

Choosing the right structure depends on factors like:

- Nature of business: Some businesses are better suited to certain structures.

- Liability: Consider the level of personal risk you're willing to take.

- Capital needs: How much funding will you require?

- Compliance: Evaluate the level of regulatory burden you can handle

It's advisable to consult with mybusinessregistration experts to determine the most suitable structure for your specific needs.

Document Required For Proprietorship Firm Registration

- Aadhar Card

- Pan Card

- Bank Account

- Registered Office Proof

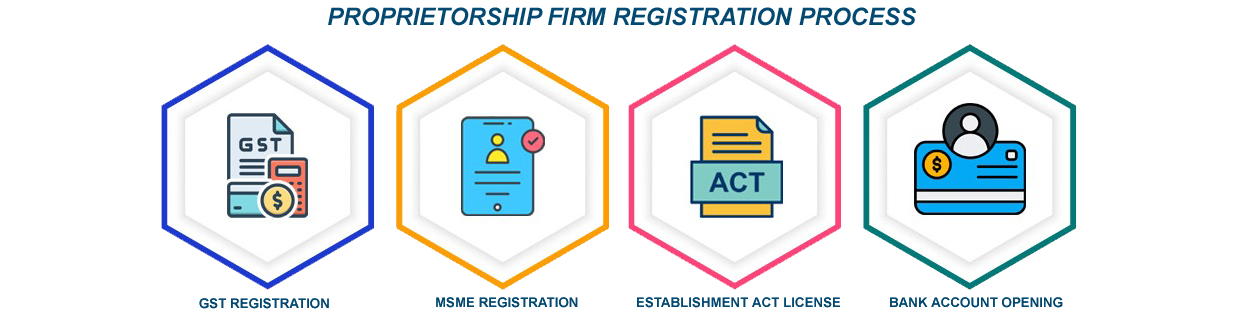

- Registering as SME

- Shop & Establishment License

- GST Registration